The Wal-Mart / Amazon / Big-Box Picture

There is a storm brewing with Wal-Mart leading the charge to push vendors for lower prices and it started on July 1, 2015. Wal-Mart, Amazon and others are pushing vendors to take deeper discounts and reduce prices, but with tactics that can affect your revolving loan / asset based lending collateral. The Wal-Mart fees, stocking charges, advertising curtailments and more are typical of what is also happening with sales to Amazon and other Big-Box Stores (B-BS) retailers; there will be more and this blog is the taste of things to come in B-BS retail. Shareholder earnings take a priority when the giants come to grips with performance and the little guy (your borrower) be damned.

New Stores and New Warehouses Stocked Cheaper

Wal-Mart is seeking to have vendors take a discount of perhaps 10% to stock new warehouses and new stores. You might wonder why?

- Because the holding period is longer until normal flow builds up

- Because there is a higher cost to stock and open new stores and warehouses

- Because Wal-Mart wants to compete with Amazon and someone needs to pay for that

- Because they can

Handling Fees

Another new addition at Wal-Mart will be handling fees for the existing warehouses and the follow-up (not initial order) to stock the shelves at the warehouse. Stocking fees are not new, they are just going to be more pervasive now. Items like liquor and certain perishable goods will be exempt from this stocking fee.

Store Branded Products and Electronic Advertising are Growing

Wal-Mart is changing some of that co-op advertising that they have done because on-line e-tailing is growing and since Wal-Mart owns the web servers, there is little added cost to run Wal-Mart products right along other vendor’s products. Perhaps more than a little competition with priority placement for Wal-Mart goods? But there is a ton of money in that advertising cost and the strategies to reduce vendor advertising expenses and pass the savings to Wal-Mart include:

Wal-Mart is changing some of that co-op advertising that they have done because on-line e-tailing is growing and since Wal-Mart owns the web servers, there is little added cost to run Wal-Mart products right along other vendor’s products. Perhaps more than a little competition with priority placement for Wal-Mart goods? But there is a ton of money in that advertising cost and the strategies to reduce vendor advertising expenses and pass the savings to Wal-Mart include:

- Having vendors cut their end-display, banners and display costs to pass that savings to Wal-Mart

- Having the vendors stop preparing on-line marketing materials (artwork , Etc.) to reduce vendor costs

- Having the vendors reduce their internal marketing efforts that push sales to Wal-Mart

So now we have a Giant telling the vendor how to sell their product and how to save costs on marketing while simultaneously pushing Wal-Mart products as featured items on-line and through other marketing materials. Store brands vs. name brands and the store decides what gets top billing.

Discounts – Out with the Old, In with the New

Prompt-pay discounts are nothing new and in some economies they go away and in others they are more prevalent. Some of the normal Wal-Mart Terms were 1%/N20 and this of course helped vendors to pay for payroll and materials. But the “new deal” is an additional 1% (2% total) and a stretch W A Y – W A Y – W A A A A A Y Y Y — out to 90 days (ninety days in case you fell off your chair). Not sure what the terms are if you don’t take the 90 days and 2% discount?

Prompt-pay discounts are nothing new and in some economies they go away and in others they are more prevalent. Some of the normal Wal-Mart Terms were 1%/N20 and this of course helped vendors to pay for payroll and materials. But the “new deal” is an additional 1% (2% total) and a stretch W A Y – W A Y – W A A A A A Y Y Y — out to 90 days (ninety days in case you fell off your chair). Not sure what the terms are if you don’t take the 90 days and 2% discount?

Slow Goods = Slow Pay

Goods that turn slower than normal in the stores will be expected to take even longer pay period changes. Goods that sit on the shelf for more than 60, 90, 120 days will be penalized with extended pay terms and many will still be subject to the discounts.

Goods that turn slower than normal in the stores will be expected to take even longer pay period changes. Goods that sit on the shelf for more than 60, 90, 120 days will be penalized with extended pay terms and many will still be subject to the discounts.

They Can Bank on It $$$$$

Wal- Mart is also extending their reach into the financing of these goods. Vendors that lack the appropriate lines of credit can get their financing from Wal-Mart and the rates may be more favorable than some lending relationships from revolving lines of credit or factoring.

Warehouse Cost Savings to the Borrower?

If you are a manufacturer and Amazon or Wal-Mart of some other B-BS is your warehouse, that might actually be an OK deal. Think about how much it costs to run a warehouse, finance or rent it, insure it, provide security, utilities, employees, forklifts, Etc. and this B-BC warehouse management case could be a good deal for some; it is not all bad in many cases to pay the fees if this saves the warehouse costs.

Let’s Add-Up The ABL Reserves

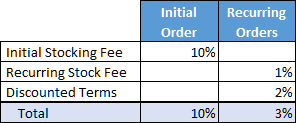

A Summary Please

At this time it is not clear if the discounted terms fee or the stocking fee will be applied to the initial order (new stores or New Warehouse), time will tell soon enough. Different vendors could have different terms than noted here and it will certainly vary from one B-BS to another. This illustration of the 10% Initial order (new stores or new warehouses) and then ongoing fees is just one possible scenario. Clearly you’ll need to investigate, document and then monitor the case for each Account Debtor and each of your Borrowers.

At this time it is not clear if the discounted terms fee or the stocking fee will be applied to the initial order (new stores or New Warehouse), time will tell soon enough. Different vendors could have different terms than noted here and it will certainly vary from one B-BS to another. This illustration of the 10% Initial order (new stores or new warehouses) and then ongoing fees is just one possible scenario. Clearly you’ll need to investigate, document and then monitor the case for each Account Debtor and each of your Borrowers.

That Was Fun, More Numbers Please

This will stretch out your Borrowing Base loan and collateral days and that means more interest income to Lenders while possibly increasing ineligible risks if care is not extended to allow for the longer terms (see recommendations below). Moving from 20 days to pay to 90 is a whopping 450% increase in outstanding days and it could push concentration limits to untested levels for some lenders. Actual days could be more with normal paperwork processing, transit time, mail time, Etc.; although the 450% (600% if you go to 120 days) difference would have the same 5-7 additional days (reality) in the case of 20 day or 90 day terms plus any additional processing time.

How will that affect your Borrowing Base? It’s going to have more days of cash outstanding for sure and in many cases the concentration levels of Wal-Mart, Amazon, other B-BSs will double or triple if monthly shipments are the norm; expect temporary concentration issues on seasonal goods.

Cushion is Toast, Concentrations are Up!

Asset Based Lenders typically use a 90 day eligible base and with normal 30 day payment terms, the AR turns in 35-45 days in many cases. Assume an average 42 days of AR turnover and the lender has 48 days (90 – 42 = 48 days) of “cushion” remaining in case of delays of payments within that 90 day limit. That cushion in this example is 53% (48/90). But add the Wal-Mart case with 90 or 120 day payment terms (longer on slower turning goods) and you can see that your ineligible cushion days are up in smoke while your concentration balance goes way up.

Asset Based Lenders typically use a 90 day eligible base and with normal 30 day payment terms, the AR turns in 35-45 days in many cases. Assume an average 42 days of AR turnover and the lender has 48 days (90 – 42 = 48 days) of “cushion” remaining in case of delays of payments within that 90 day limit. That cushion in this example is 53% (48/90). But add the Wal-Mart case with 90 or 120 day payment terms (longer on slower turning goods) and you can see that your ineligible cushion days are up in smoke while your concentration balance goes way up.

Other Lender Considerations

The Bank of Wal-Mart (TBOW / Bank of Big-Box Stores = BOBBS)

The trade finance provided by Wal-Mart is both competition to existing lenders and a move into financing that has been coming for a long time. We all know about the small branch office bank at our local grocery store and perhaps Wal-Mart and similar B-BC stores. Consumer lending and one-stop banking could carry the TBOW / BOBBS brand in the future. It’s easy to imagine financing your car or house with that convenience and you might also get a great rate.

It is a bit of a nightmare to imagine Wal-Mart or another B-BS double squeezing a Vendor that relies on Wal-Mart sales and has Wal-Mart financing for those goods. The possible threats of reduced Wal-Mart purchases and financing offsets against money owed to the Vendor carry borderline ethical and legal undertones for squeeze-play tactics. Any BOBBS in a work-out the vendor situation sounds like a new chapter in finance. Regardless of how transparent this might be, the net cash back to the vendor (your Borrower) is going to be after the fees and interest.

Offsets?

Secured Lenders want a first position lien on all assets now and hereafter acquired through blanket liens. The TBOW financed piece is a carve-out from secured loan collateral with Wal-Mart holding the inventory and payable and then TBOW getting the proceeds from sales to date and acting as recipient of the interest earned and fees owed. With Wal-Mart paying TBOW (themselves), Lenders will need to remain diligent to catch such offsets and to carve out the collateral reserves needed for the discounts, fees and interest.

Ratios

Wal-Mart’s Current Ratio will take a trip to the other side because retail and on-line sales have instant cash turnover on the Asset Side and now the payables are going to mushroom into something new. Like the original Dell model (7 day cash turn, 30 day payable turn), expect negative working capital ratios for Wal-Mart. Your borrower on the other hand is going to get dinged for having growth in both receivables and the revolving loan, but your AR turnover numbers are going to take a hit where the B-BS retailers dominate while your liquidity and debt to equity ratios are going to change a bit too.

Some Recommendations

The following list will no-doubt be expanded in the months to come, but the basics should not be overlooked:

- Interview the Borrower and determine the extent of Wal-Mart and other B-BS terms in place.

- Get copies of the Purchase Orders and Contracts from all B-BS and Concentration accounts and read them in detail to determine the levels of invoices affected. You might find no issues at all or you’ll be able to quantify the needs for loan monitoring of specific Account Debtors when special terms are found.

- Have the Borrower designate the 10% initial sales invoices with specific markings such as:

- Credit Terms stated in the aging as Wal-Mart 10% Stocking Fee, Net 90 (WM10/N90)

- Specific Invoice sequences used for invoices that include the initial stocking fees

- Separate Wal-Mart Accounts for the Initial Orders (E.G., Wal-Mart Warehouse 999999 Initial Stocking)

- Put the B-BS stores on a separate aging report, as if they were a division of the Borrower’s company. Note that from an operations standpoint this might help the company to see the profit and costs of those B-BS sales in a more focused (divisional) light.

- Be smart about GAAP accounting and revenue recognition procedures. Because the Borrower has full knowledge of the terms, they must book the reserves when the sale is made; this is a sure-thing discount, much like negotiated / contractual medical rates with Insurance Companies. While B-BS accounting will be tracking their discounts earned against the gross invoice, the seller is your Borrower and they have a potentially large offset here. These terms are not a normal 1/2% or 1% discount taken at the time of the cash receipt from some debtors that do take the discounts; rather, this is a sure thing and it should be reserved on your Borrower’s books as a discount to revenues. They can fix it if the discount is not taken.

- TBOW / BOBB could file liens to help secure the notes and one would expect at a minimum the right to offset fees owed against payments due would be in the agreements. Running a lien search on your Borrower is prudent. Perhaps Wal-Mart and others will make this easier to determine after they are inundated with inquiries to make this easier.

- Run those Lien searches on ALL locations and ALL names that your Borrower has.

- Discuss filing Purchase Money Security Interest (PMSI) filings to see if that makes sense for your collateral coverage. The time and effort to file on many customers (Account Debtors) is often a negative if you are not in the trade finance business, but here you are just filing on just Wal-Mart or other B-BS. Expect push-back on any such filings, but they can’t expect silence on collateral lien filings methods allowed by law.

- Modify the Loan and Security Agreements to compensate for the change in business terms. Due date aging reports or due date aging for extended term customers should be investigated. This needs to be done now, we’re into July and reality is ticking away inside your new sales to Wal-Mart and possibly others. It is going to affect all of your loans that have Wal-Mart / B-BS debtors.

- Download your agings to help find this stuff. We’re #1 at this (www.finsoft.net).

- As noted in the opening paragraph to this Blog, you’ll be seeing this with Wal-Mart, Amazon and other B-BS retailers in the coming months. Plan to deal with this now.

- No way to know how the OCC is going to look at this. Portfolio concentration by major debtor across your portfolio has some risks with the likes of Wal-Mart, Lowes, Home Depot, Etc., but it has not been a significant concern with prior payment terms and turnover of AR into cash. This will raise concentration levels to a much higher level and portfolio-wide concentration analysis or incremental risk rating downgrades and resulting reserves could become a regulatory requirement. It might be poetically funny if some of the B-BS “lenders” (The BOBBS) are perceived as giant financiers worthy of OCC oversight, complete with special reserve requirements [just saying… It happened to CIT, GE Capital, Etc.].

- Recalculate your ratios for Liquidity and Debt to Equity, the AR is going to grow on the Asset side with loan growth on the Liability side. You may need to adjust covenants due to a change in business practices that are not under the control of the Borrower.

- Watch interest coverage and debt payment coverage, you might see less of it. Again, adjust covenants if needed due to a change in business practices that are not under the control of the Borrower.

- While Lenders will enjoy higher earnings on commercial loans from this change, the interest cost sensitivity for low equity and marginal income Borrowers could be a tipping point for some and sensitivity analysis for those at risk may be helpful in being proactive with covenant changes to avoid technical or [gulp] real defaults.

- Have some feedback on this; something to correct, change, add, Etc.? Send us a note and it will get added based on merit.

- We’ll be adding Big-Box Discounts to ABL-Help Classic and Pro for the next release and you should be using this tool anyway.

Yet another ineligible to consider. ![]()

Further Reading:

http://www.reuters.com/article/2015/06/24/us-wal-mart-stores-suppliers-idUSKBN0P400K20150624

http://www.wsj.com/articles/wal-mart-ratchets-up-pressure-on-suppliers-to-cut-prices-1427845404

http://www.scdigest.com/assets/on_target/15-07-06-1.php?cid=9481

Copyright © 2015 Clear Choice Seminars, Inc. All Rights Reserved

Images licensed from Fotolia.com or created by Joseph R. Caplan © 2015 All Rights Reserved